scripting,automation,money

Tracking your money without breaking your banks TOS

How to get a near-realtime feed of transactions from your bank, without giving up your credentials or making them unhappy.

If you spend any amount of time trying to automate your life, then getting a feed of your transactions into your automation seems like a worthwhile step. This enabled me to keep track of transactions in a structured database, and keep a realtime view of how I was spending against my budget.

How not to do it

- Use a browser automation framework to scrape your banks website

- Reverse engineer your banks app/site and immitate their requests to get the data

- Use a 3rd-party app which does budgeting or itemization, and scrape that service/site

- They put your credentials at risk - Scripting a login into your bank implies providing your script (or worse, a 3rd-party app) with your login details. If your script/computer/the-3rd-party ever get compromised, expect your money to disappear.

- They violate your banks TOS - Going against your bank means incurring all the liability if things go wrong. Each to their own, but I want to stay on good terms with the people protecting my money.

The safer + TOS-friendly approach

Most banks (indeed Wells Fargo) have a 'transaction alert' feature, where they will send you an SMS/email when a transaction over a certain amount is made against a specific account. We leverage this feature to have the bank give us a heads up with each transaction, without compromising login credentials or breaching the terms-of-service.I did the following:

- Use Gmail filters to forward alert emails from Wells Fargo to my Nexus (think of it as a personal lambda) instance.

- Parse the emails to extract description, credit card suffix, date, and amount. Write this into a database.

- Match descriptions against hand-written rules to categorize them.

- Render everything in a pretty dashboard.

Email parsing

The following is is my lambda function to handle the forward alert emails.function contains(str, substr) {

return str.indexOf(substr) !== -1;

}

String.prototype.startsWith = function(search, pos) {

return this.substr(!pos || pos < 0 ? 0 : +pos, search.length) === search;

};

String.prototype.replaceAll = function(search, replacement) {

var target = this;

return target.split(search).join(replacement);

};

function findTrailingValue(lines, prefix) {

for (var i = 0; i < lines.length; i++) {

if (lines[i].startsWith(prefix)) {

return lines[i].substring(prefix.length).replace('\r', '');

}

}

return null;

}

function commitTransaction(acc, desc, amt, meta) {

var insert = datastore.insert("Transactions", {

account: ''+acc,

timestamp: Date.now(),

amount: amt,

description: desc,

category: '',

subcategory: '',

metadata: JSON.stringify(meta || {source: 'email'}),

});

if (insert.success) {

console.log("Successfully saved transaction: ", desc);

console.log("rowID: " + insert.rowID);

} else {

console.error("Insert failed.");

console.data(insert);

}

}

if (context.run_reason == "EMAIL") {

if (message && contains(message.subject, "Wells Fargo card purchase online")) {

var spl = message.text.replace('\r', '').split('\n');

var acc = 'wf-card-x'+findTrailingValue(spl, "Card ending in ");

var desc = findTrailingValue(spl, "Merchant details at ");

var amt = parseFloat(findTrailingValue(spl, "Purchase amount ").split(" ")[0]);

commitTransaction(acc, desc, amt);

} else if (message && contains(message.subject, "Wells Fargo card purchase exceeded preset amount")) {

var spl = message.text.replace('\r', '').split('\n');

var acc = 'wf-card-x'+findTrailingValue(spl, "Card ending in ");

var desc = findTrailingValue(spl, "Merchant details at ");

var amt = parseFloat(findTrailingValue(spl, "Purchase amount ").split(" ")[0]);

commitTransaction(acc, desc, amt, {source: 'email', card_present: true});

} else if (message && contains(message.subject, "Wells Fargo credit card purchase exceeded pre-set amount")) {

var spl = message.text.replace('\r', '').split('\n');

var acc = 'wf-card-x'+findTrailingValue(spl, "Credit card XXXX-XXXX-XXXX-");

var desc = findTrailingValue(spl, "Purchase location at ");

var amt = parseFloat(findTrailingValue(spl, "Purchase amount ").split(" ")[0]);

commitTransaction(acc, desc, amt, {source: 'email', card_present: true});

} else if (message && contains(message.subject, "Wells Fargo credit card online, phone, or mail purchase")) {

var spl = message.text.replace('\r', '').split('\n');

var acc = 'wf-card-x'+findTrailingValue(spl, "Credit card XXXX-XXXX-XXXX-");

var desc = findTrailingValue(spl, "Purchase method at ");

var amt = parseFloat(findTrailingValue(spl, "Purchase amount ").split(" ")[0]);

commitTransaction(acc, desc, amt, {source: 'email', card_present: true});

}

}

Rule-based categorization

In this step, another lambda function processes the database entries, and matches them against a structured set of categories + match rules. I can't show you the full code with expense_classes.json unfortunately; transaction descriptions are not anonymous enough to put on the internet.function categorizeTransactions() {

var q = datastore.query("Transactions", [{value: "", column: "category", condition: "=="}]);

if (!q.success)

throw "Datastore query failed";

var rules = JSON.parse(fs.read("/minifs/expense_classes.json"));

for (var i = 0; i < q.results.length; i++) {

applyTransactionRules(q.results[i], rules);

}

}

Pretty dashboards!

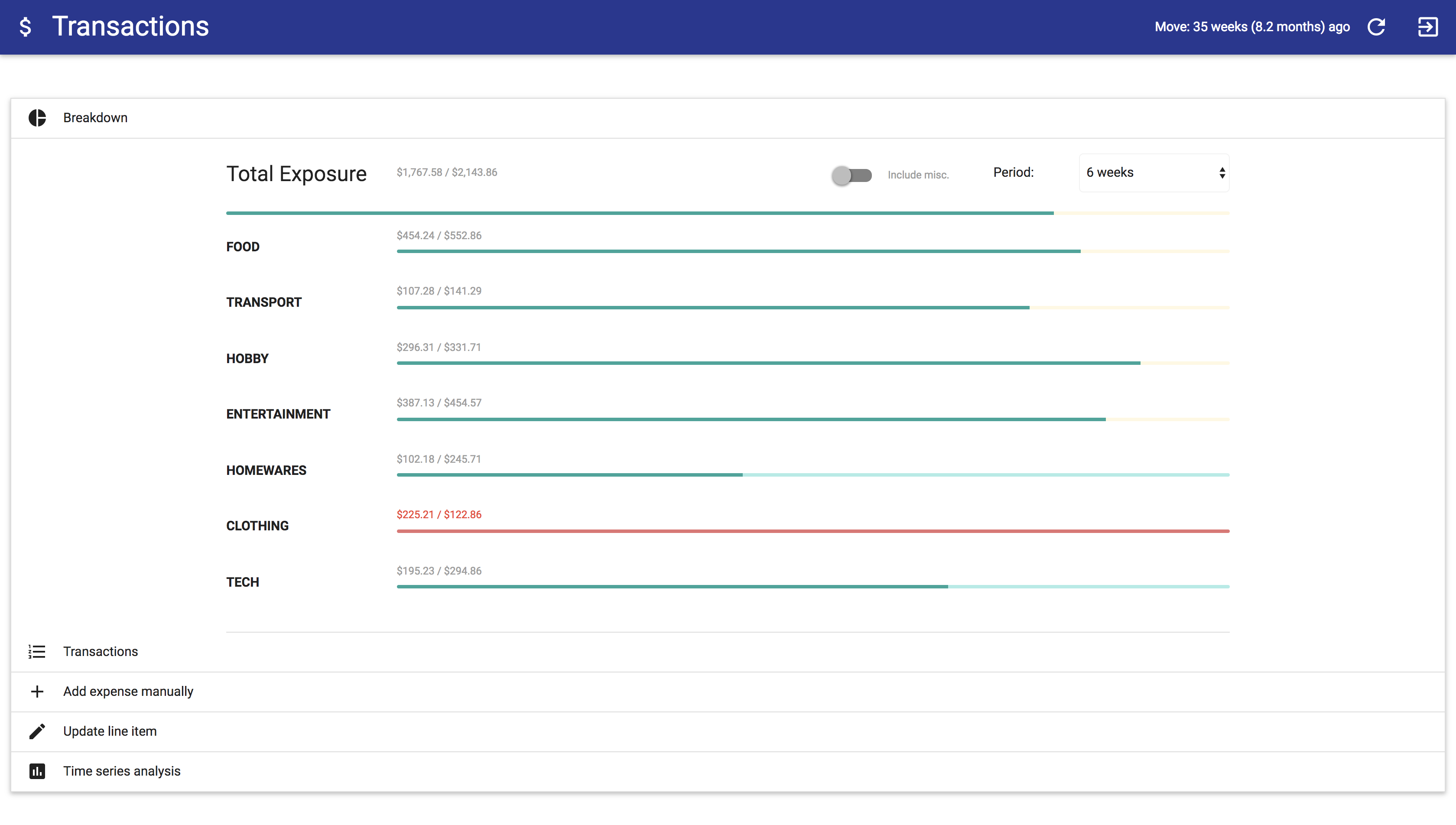

Combine the data with a sneaky Angular frontend, and voila! Easy tracking of recent spending against budget goals.

(Before you ask, this is fake data - who spends $55 a week on hobbies? :P)

Combine the data with a sneaky Angular frontend, and voila! Easy tracking of recent spending against budget goals.

(Before you ask, this is fake data - who spends $55 a week on hobbies? :P)